R&D Blog

The Adaptive Markets Hypothesis: A. W. Lo

Andrew W. Lo:

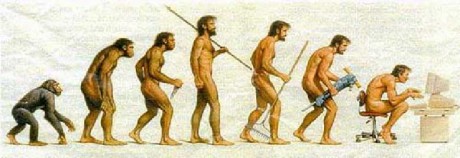

Based on evolutionary principles, the Adaptive Markets Hypothesis (AMH) implies that the degree of market efficiency is related to environmental factors characterizing market ecology such as the number of competitors in the market, the magnitude of profit opportunities available, and the adaptability of the market participants. Many of the examples that behavioralists cite as violations of rationality that are inconsistent with market efficiency—loss aversion, overconfidence, overreaction, mental accounting, and other behavioral biases—are, in fact, consistent with an evolutionary model of individuals adapting to a changing environment via simple heuristics. The primary components of the AMH consist of the following ideas:

(A1) Individuals act in their own self-interest.

(A2) Individuals make mistakes.

(A3) Individuals learn and adapt.

(A4) Competition drives adaptation and innovation.

(A5) Natural selection shapes market ecology.

(A6) Evolution determines market dynamics.