R&D Blog

Global Market Correlations: 1995-2014 | Data Analysis

I. Research Goal

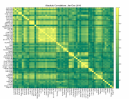

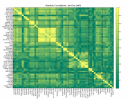

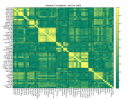

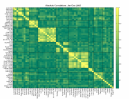

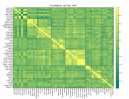

Review of market correlations for eight core groups: (a) Equities; (b) Interest Rates; (c) Currencies; (d) Energy; (e) Metals; (f) Grains & Oilseeds; (g) Livestock; (h) Softs & Woods. Results: Figure 1-2. Test Setup: Market Returns = ln(Close[n] / Close[n − LookBack]), where LookBack = 10 bars. Correlation window is 256 bars. Data: 20 years (1995-2014). Testing Platform: MATLAB®.

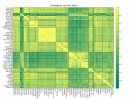

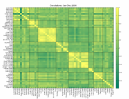

II. Absolute Market Correlations

Figure 1 | Data: 1995-2014.

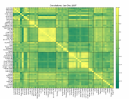

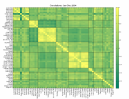

III. Market Correlations

Figure 2 | Data: 1995-2014.

IV. Markets (Symbols)

Currencies: AUD/USD (AD), GBP/USD (BP), CAD/USD (CD), EUR/USD (CU), Dollar Index (DX2), JPY/USD (JY), MXN/USD (MP), NZD/USD (NE), CHF/USD (SF). Energy: Light Sweet Crude Oil (CL2), Heating Oil (HO2), Brent Crude (LCO), Natural Gas (NG2), RBOB Gasoline (RB2). Equities: E-mini S&P MidCap 400 (EMD), CAC 40 (FCH), DAX (FDX), FTSE 100 (FFI), Nikkei 225 (NK), E-mini NASDAQ 100 (NQ), OMXS30 (O30), S&P 500 (SP2), Euro STOXX 50 (SXE), E-mini DJIA (YM). Grains & Oilseeds: Soybean Oil (BO2), Corn (C2), Oats (O2), Rough Rice (RR2), Soybeans (S2), Soybean Meal (SM2), Wheat (W2). Interest Rates: Euro-Bund (EBL), Euro-Bobl (EBM), Euro-Schatz (EBS), Eurodollar 3-Mth (ED), Euribor 3-Mth (FEI), Long Gilt (FLG), Short Sterling (FSS), US 5-Year T-Note (FV), US 2-Year T-Note (TU), US 10-Year T-Note (TY), US 30-Year T-Bond (US). Livestock: Feeder Cattle (FC), Live Cattle (LC), Lean Hogs (LH). Metals: Gold (GC2), Copper (HG2), Palladium (PA2), Platinum (PL2), Silver (SI2). Softs & Woods: Cocoa (CC2), Cotton #2 (CT2), Coffee (KC2), Lumber (LB), Orange Juice FCOJ-A (OJ2), Sugar #11 (SB2).

V. Excel Data

Absolute Correlations (.xlsx, 897 KB) ![]()

Correlations (.xlsx, 911 KB) ![]()

Codes: matlab/dataanalysis/correlations/